We deliver consistent, uncorrelated alpha through liquid futures investments.

Program description

Comprehensive Investment Strategy

The strategy is fundamentally-based, 100% systematic, and employs uncorrelated, consistent, and repeatable ideas.

Gnomon Alpha trades in developed liquid markets, including equities, fixed income, currencies, and commodities, both long and short, using futures.

Low correlation to equities/CTAs/FOHFs/bonds & downside protection in critical months.

Highly Liquid and Scalable.

When added to a portfolio’s asset allocation framework, Gnomon Alpha Global Macro can improve the return and risk characteristics and prove especially useful when markets are volatile.

Gnomon Alpha Advantage

A Diversifying Source of Returns

We provide investors with an opportunity for positive returns, including, but not limited to, periods when traditional assets, such as stocks and bonds, may be struggling.

Adding a diversifying source of returns also reduces a portfolio’s

overall volatility.Our Fund can go Long and Short and invest and trade in many diverse markets, it can perform in up-and-down stock and bond markets.

Our track record demonstrates significant positive returns in periods of dislocation when investors and portfolios need those returns the most.

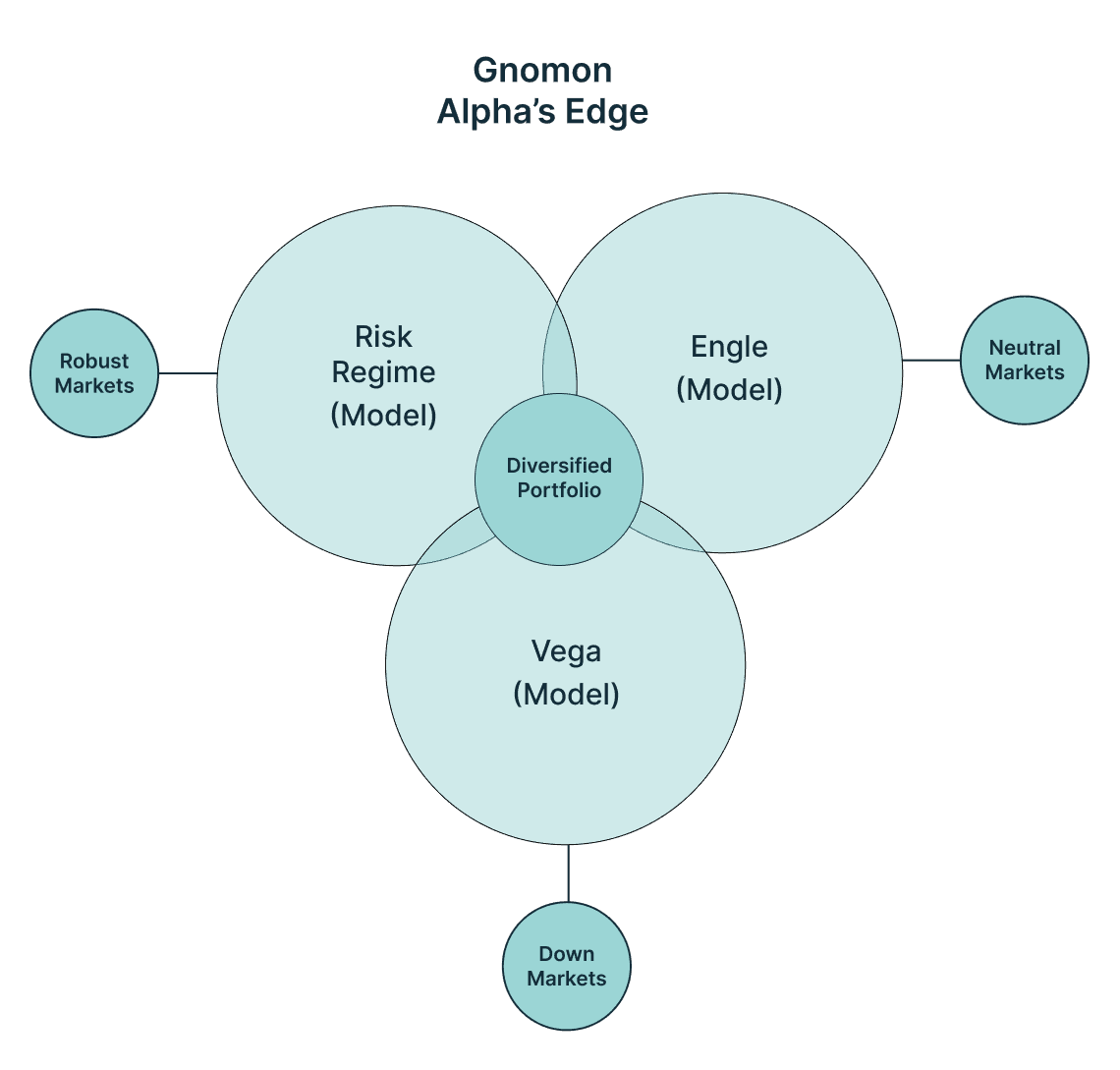

Gnomon Alpha's edge

Diverse Trading Models for Consistent Alpha

Gnomon Alpha employs three trading models that profit from a diverse set of market environments: robust markets, neutral markets, and down markets.

The Risk Regime model does especially well during periods of robust demand for commodities and financial assets.

During times when markets are neutral, however, the Engle model takes advantage through its long/short trading process that dynamically scales the trade according to the opportunity.

And, when markets head downwards, the Vega model performs its sole job, which is to trade global equity indices from the short side only.

Together, these models create a diversified portfolio that provides consistent, uncorrelated sources of Alpha.

Get in touch

Connect with us today.